The Role of a Personal Injury Lawyer in Insurance Disputes

After a serious injury, most people expect their insurance company to step in and help. But too often, the process turns into a battle. Claims get denied. Payments get delayed. Offers come in far lower than what’s needed to cover medical bills, lost income, and long-term recovery.

Insurance disputes don’t just add paperwork. They add stress, confusion, and financial pressure at a time when you’re already hurting. You may feel like no one is listening or fighting for what’s fair.

That’s where a personal injury lawyer steps in.

At Selingo Guagliardo, we’ve helped people across Pennsylvania stand up to insurance companies and get the compensation they’re owed. Insurance disputes happen, they’re hard to fight alone, and having a lawyer on your side can make all the difference.

What Is an Insurance Dispute?

An insurance dispute happens when there’s a disagreement between you and an insurance company about your personal injury claim. After an accident, you expect coverage for your medical bills, lost wages, and other damages. But insurance companies don’t always agree with the amount you’re claiming, or whether you’re entitled to anything at all.

Disputes come in several forms:

Claim denials: The insurer refuses to pay, sometimes claiming your injuries aren’t covered or that you were at fault.

Low settlement offers: The company admits some responsibility but offers far less than what your claim is worth.

Delays: The insurer keeps pushing off a decision or payment, creating financial pressure until you settle for less.

These tactics often leave injured people stuck. Meanwhile, the insurance company has teams of professionals trained to minimize payouts.

Why does this happen? It comes down to profit. Insurers are businesses. The less they pay in claims, the more they keep in earnings. Some will look for technicalities, policy loopholes, or vague language in your contract to justify paying less, or nothing at all.

That’s why it’s critical to know your rights and understand how the claims process works. If you feel like the insurance company isn’t being fair, you’re not alone. Many clients come to Selingo Guagliardo after trying to handle the process themselves and running into roadblocks they didn’t expect.

Why Insurance Disputes Are So Difficult for the Injured

Most people file an injury claim only once in their life. Insurance companies handle thousands every year. That difference puts you at a disadvantage from the start.

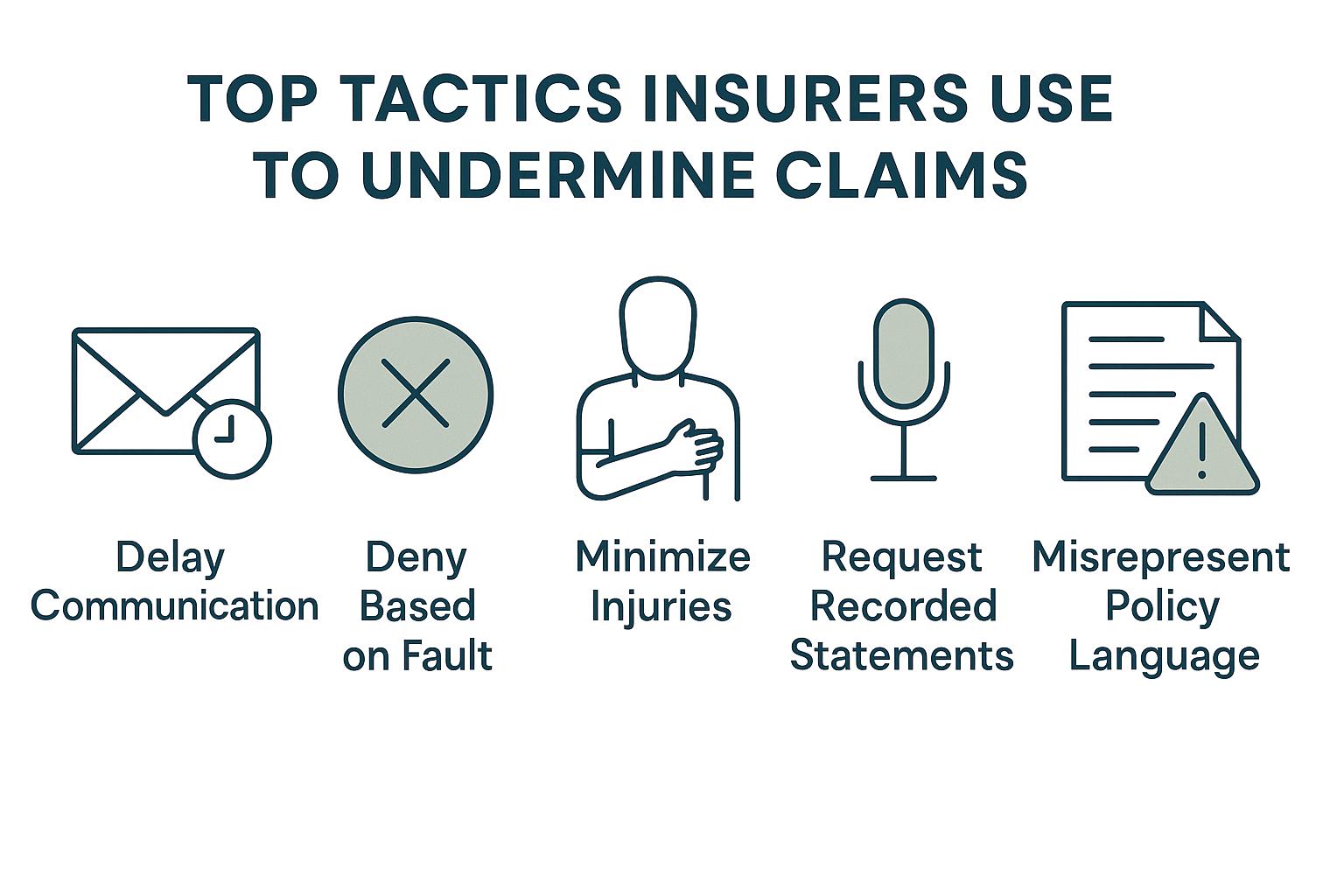

Insurers rely on tactics that benefit them, not you. They may delay processing your claim, pressure you to give a recorded statement, or make a fast cash offer that barely covers your expenses. These strategies work because people are stressed, injured, and unsure of their rights.

While you're focused on healing, the insurance company is focused on limiting what it pays. Many injured people accept low settlements because they don’t realize they can push back.

At Selingo Guagliardo, we regularly help clients who feel stuck or ignored. If you're facing obstacles from an insurance provider, take a look at how we approach insurance claim disputes by visiting our insurance disputes page. It explains what we do when the process breaks down and what your options are when a claim isn't being handled fairly.

For a broader look at how insurers are expected to act, the Legal Information Institute offers a helpful overview of an insurer’s duty of good faith.

How a Personal Injury Lawyer Helps

When you’re injured, the last thing you should be doing is arguing with an insurance company. A personal injury lawyer steps in to manage the claim process, push back against unfair tactics, and help you recover what you’re owed. Here’s how legal support makes a difference at each stage.

Investigate the Claim and Gather Evidence

Insurance companies require proof. Your lawyer builds that from day one. This includes accident reports, medical records, photos, statements from witnesses, and expert evaluations when needed. A strong case is rooted in solid documentation, and attorneys know what insurers expect to see.

At Selingo Guagliardo, we organize this material so there’s no confusion about what happened or how it affected you. That clarity matters when an insurer tries to challenge your version of events.

Evaluates Damages and Insurance Policies

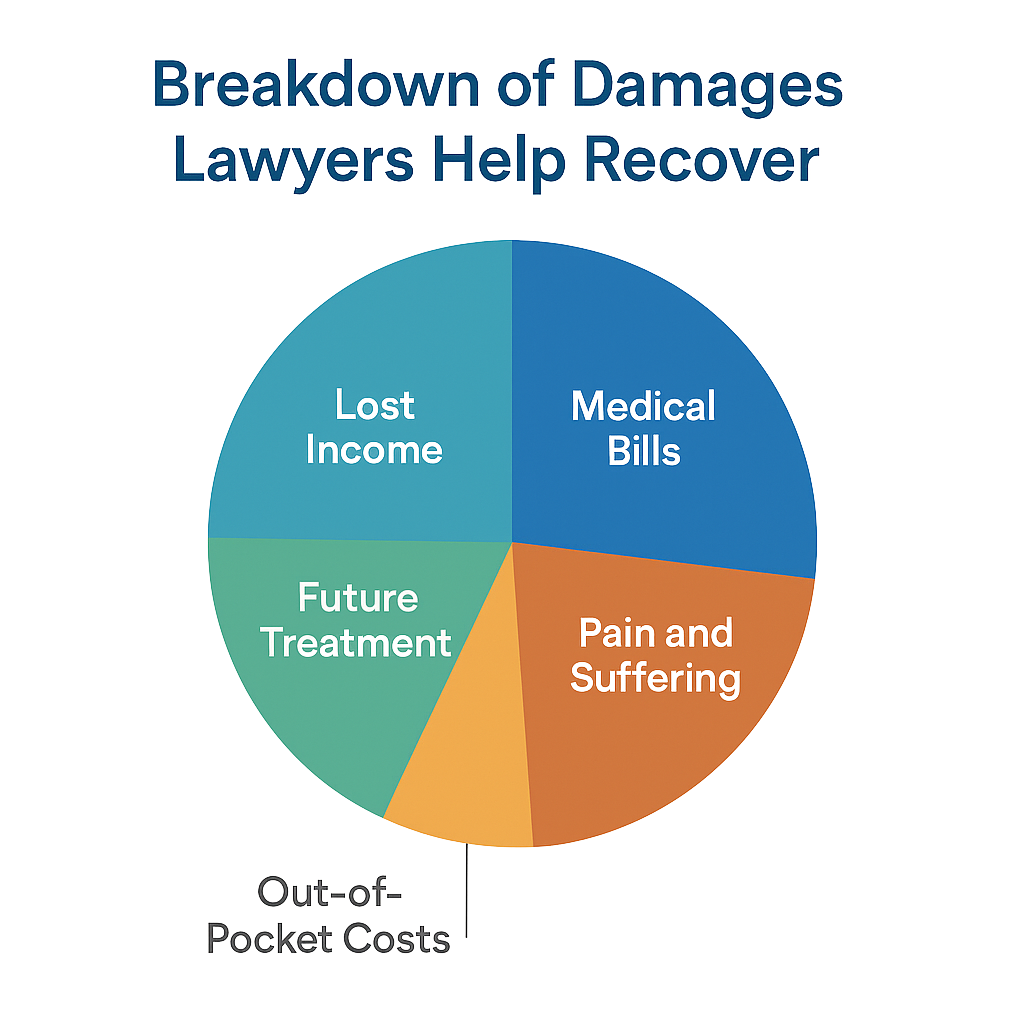

Injury claims often involve costs that aren’t obvious at first. A lawyer calculates not only your current expenses, but also lost income, future medical care, and the personal impact of the injury.

They also review relevant policies and identify limits, exclusions, or secondary coverage that may apply. These details often play a central role in insurance claim disputes, especially when insurers use unclear language to reduce payouts.

Handles Communication with the Insurer

Once you have a lawyer, you don’t have to talk to the insurance company. That’s often a relief. Adjusters may seem helpful, but their goal is to close the case quickly and cheaply.

Your attorney takes over all communication, including calls, written correspondence, and required documentation. This prevents common mistakes, like giving a recorded statement that gets used to undercut your claim.

Negotiates for a Fair Settlement

Insurers often start with an offer that sounds reasonable but falls short of covering your full losses. A lawyer reviews every offer and responds with documentation to support a more accurate number.

At our firm, we use medical records, expert input, and similar case comparisons to explain why a claim deserves more. That preparation often shifts the outcome. If negotiations stall, we offer a free case evaluation so you can understand your position before making a decision.

Identifies and Fights Bad Faith Practices

Some insurance companies cross the line. They deny valid claims without cause, delay responses, or misrepresent what’s covered. These behaviors may qualify as bad faith under the law.

Attorneys recognize these patterns and take appropriate steps. In some cases, bad faith conduct can justify legal action beyond the original claim. United Policyholders outlines what insurers are obligated to do when handling claims.

Prepares for Litigation if Needed

Most claims settle, but not all. If the insurer refuses to negotiate, your lawyer can file a lawsuit and take the case to court. This includes presenting evidence, managing deadlines, and working with experts if needed.

In Pennsylvania, the statute of limitations for most personal injury cases is two years. An attorney makes sure your case is filed on time and that no details fall through the cracks if litigation becomes necessary.

Offers Support and Peace of Mind

The legal process is hard to manage when you’re hurt, frustrated, or overwhelmed. A personal injury lawyer acts as a steady point of contact. You’ll know who’s handling your case, what happens next, and what your options are.

At Selingo Guagliardo, we stay focused on results without losing sight of the people behind each case. That support gives clients space to heal while we handle the pressure from the insurance side.

What to Do If You’re Already in a Dispute

If the insurance company is dragging its feet, denying your claim, or offering less than what you need, there are steps you can take to protect yourself:

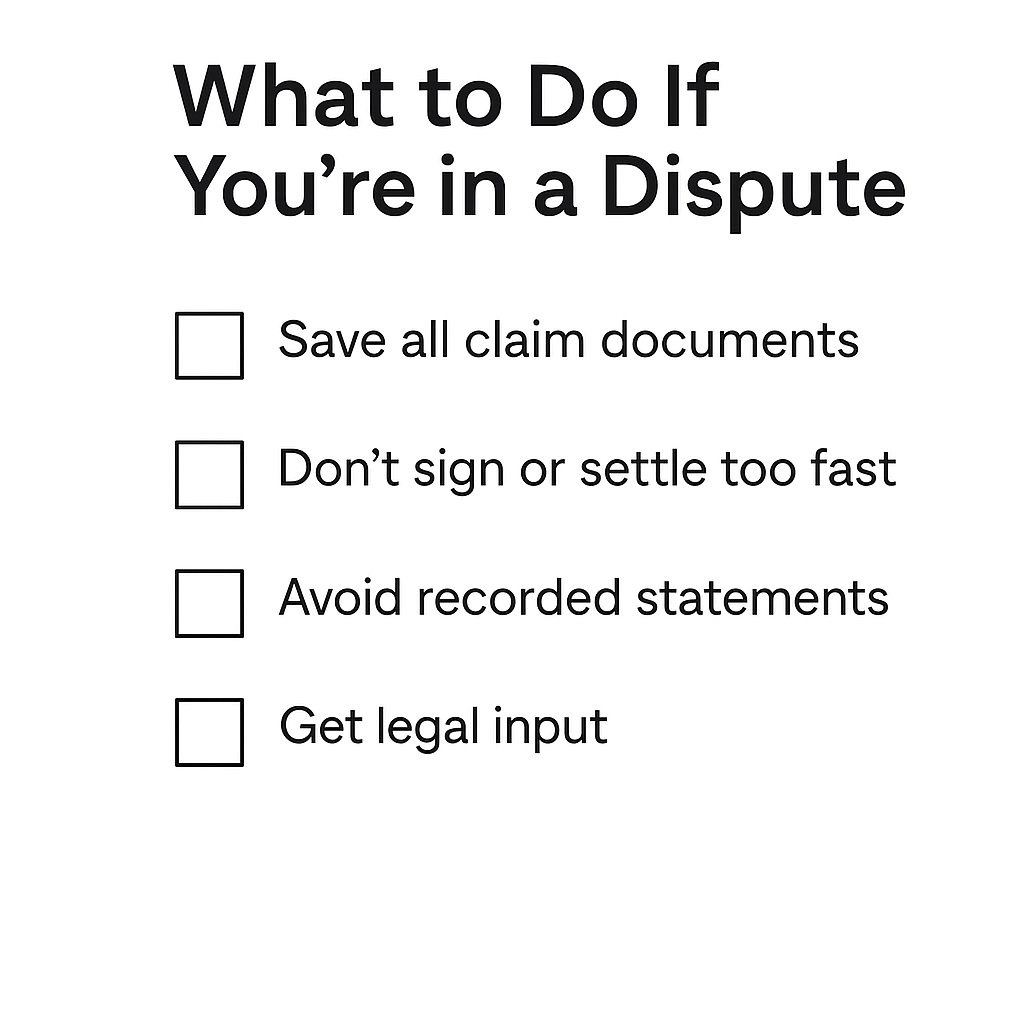

Keep track of every interaction. Save emails, letters, and notes from phone calls, including names and dates. These records can help if the insurer later changes its story.

Don’t rush to accept a settlement. Early offers are often lower than what your claim is worth, especially before the full extent of your injuries is known.

Avoid giving a recorded statement. Adjusters may use your words against you. You have the right to wait until you’ve spoken with a lawyer.

Consider speaking with an attorney. A free case evaluation can help you understand your options without any pressure to move forward.

When the Insurance Company Won’t Work With You

Insurance disputes don’t just create delays. They keep injured people from moving forward. You may be doing everything right and still find yourself blocked by low offers, vague explanations, or no response at all.

This is where legal help changes the dynamic. A personal injury lawyer handles the pressure, keeps the claim on track, and holds the insurer accountable. At Selingo Guagliardo, we take that role seriously because we’ve seen what’s at stake for the people we represent.

If you're unsure whether your claim is being handled fairly, you can learn more about how we manage insurance coverage disputes and what to expect during the process.

You shouldn’t have to fight for basic fairness alone. We’re here to help you get answers and move forward.

Frequently Asked Questions (FAQs) About Insurance Disputes

-

An insurance dispute happens when the company delays, denies, or underpays your claim. This can involve questions about fault, policy coverage, or the value of your damages.

-

If the offer seems low or doesn’t cover all your expenses, it’s worth getting a legal opinion. Once you accept, you usually can’t reopen the claim, even if new costs come up.

-

They can’t legally deny a valid claim without explaining why. If they do, it may be a sign of bad faith, and a lawyer can help hold them accountable.

-

Most personal injury claims in Pennsylvania must be filed within two years from the date of injury. Missing that deadline could block your case completely.

-

Most lawyers, including our team at Selingo Guagliardo, work on a contingency fee basis. That means you don’t pay anything up front, and we only get paid if you recover compensation.