How to Handle an Insurance Bad Faith Claim

When you buy insurance, you expect the company to keep its promise. You’ve paid your premiums and followed the rules. But when it comes time to file a claim, some insurers delay, deny, or underpay without a valid reason. That’s called bad faith.

Insurance companies have a legal duty to treat policyholders fairly. They may be breaking the law when they ignore evidence, refuse to explain a denial, offer an unreasonably low payout, or delay for no reason.

In Pennsylvania, policyholders have strong legal protections. If your insurer acts in bad faith, you may be able to recover the full value of your claim, plus interest, attorney’s fees, and, in some cases, punitive damages. These penalties exist to hold insurers accountable and to discourage abusive practices.

Understanding what qualifies as bad faith, how to respond, and when to escalate your claim can make a difference in the outcome. You don’t have to accept unfair treatment from your insurance company.

What is Insurance Bad Faith?

The Duty of Good Faith and Fair Dealing

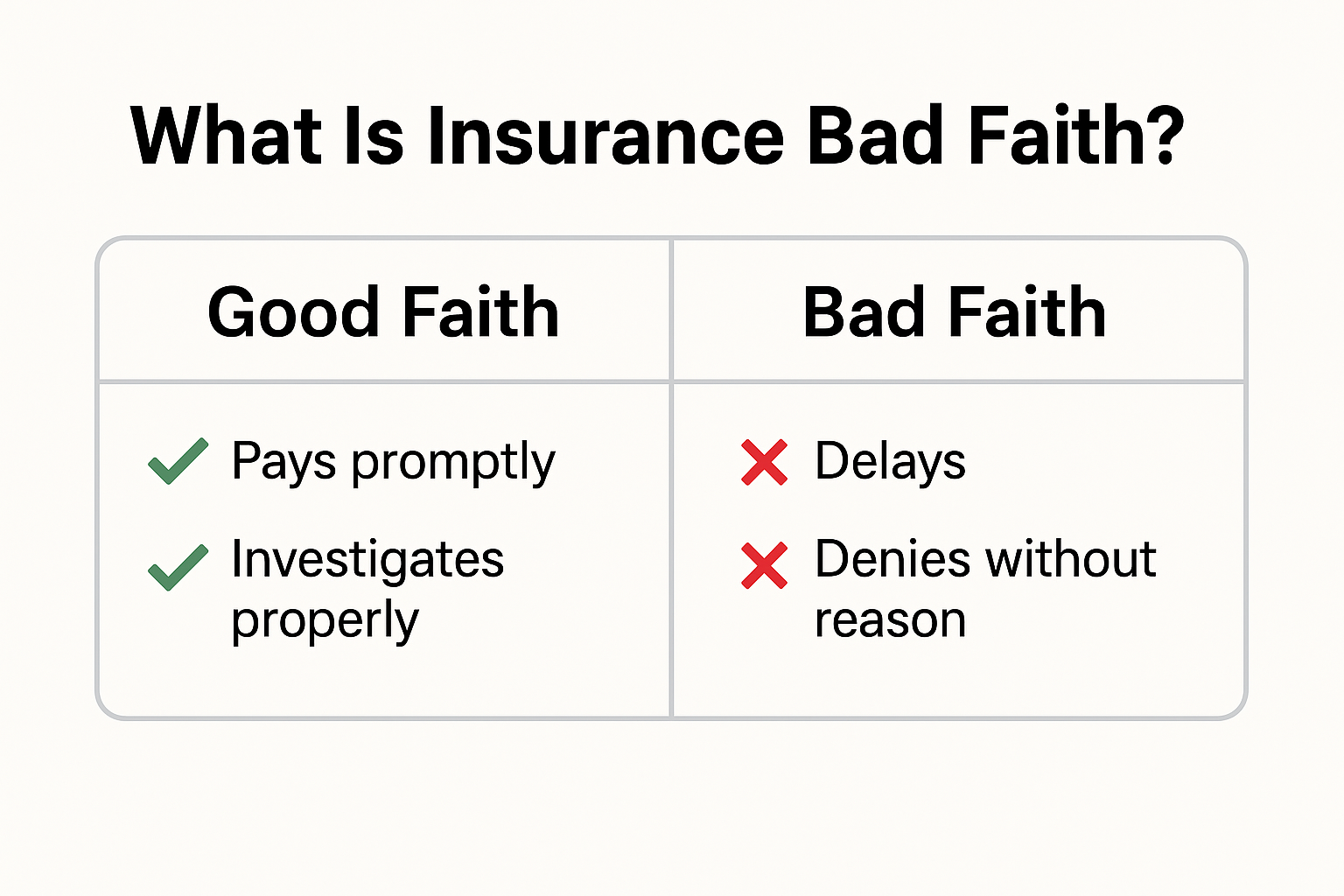

Insurance policies are contracts. You agree to pay premiums; in return, your insurance company agrees to provide coverage when something goes wrong. As part of that agreement, the law requires insurers to act in good faith. That means handling your claim fairly, honestly, and without unnecessary delay.

Bad faith happens when an insurance company breaches its duty. It’s not just about denying a claim; it’s about how it handles it. If the insurer ignores evidence, refuses to investigate, or puts its profits ahead of your rights, that may be bad faith.

Not every denial qualifies. But when an insurer acts without a reasonable basis or fails to communicate clearly and promptly, that behavior crosses a legal line.

Common Examples

Denies a Valid Claim Without a Clear Explanation

For example, you can submit documentation and follow the policy rules and still receive a vague or generic denial.

Delays in Payment or Decisions Without Justification

If your claim sits for weeks or months without updates, and calls or emails go unanswered, that may be more than poor service.

Makes a Low Settlement Offer Without Justification

The insurer might offer far less than your documented damages and refuse to explain how they calculated it.

These tactics don’t just frustrate the process. They can also be signs that the insurer is acting in bad faith,and you have the right to challenge that.

Pennsylvania’s Bad Faith Law: 42 Pa.C.S. § 8371

What You Can Recover

Under Pennsylvania law, if a court finds that your insurance company acted in bad faith, you may be entitled to several forms of compensation:

Interest on the claim amount: Calculated from the date you filed the claim, at the prime rate plus 3%

Punitive damages: Financial penalties intended to punish the insurer for egregious conduct

Court costs and attorney’s fees: Reimbursement for legal expenses incurred due to the insurer's bad faith actions

These remedies are outlined in the Pennsylvania bad faith statute.

What You Need to Prove

To succeed in a bad faith claim under § 8371, you must demonstrate two key elements by clear and convincing evidence:

The insurer lacked a reasonable basis for denying your claim.

The insurer knew or recklessly disregarded the absence of a reasonable basis for the denial.

This standard was affirmed by the Pennsylvania Supreme Court in Rancosky v. Washington National Insurance Co., ensuring that policyholders are protected even without proving the insurer acted out of self-interest or ill will.

It's important to note that Pennsylvania imposes a two-year statute of limitations on filing bad faith claims. Delaying action could forfeit your right to seek these remedies.

Recognizing Bad Faith Tactics

Red Flags to Watch For

Insurance companies are obligated to handle claims fairly and promptly. However, some may engage in tactics that undermine this duty. Be alert for these common signs of bad faith:

Denials Without Justification

If your insurer denies a claim without a reason, it may be acting in bad faith. Vague explanations or refusal to cite policy provisions are red flags.

Delays With No Explanation

Unreasonable delays in processing or paying claims, without valid reasons, can indicate bad faith. Timely communication is a basic expectation.

Misrepresentation of Policy Terms bad faith insurance tactics

If an insurer misstates or omits key details of your policy to deny or reduce a claim, it's a serious concern. Always review your policy documents carefully.

Repeated Requests for Documents Already Submitted

Continuously asking for the same documents can be a tactic to frustrate claimants and delay the process. Keep records of all communications and submissions.

Understanding these bad faith insurance tactics is crucial.

Step-by-Step Guide to Responding to Bad Faith

When you suspect your insurance company isn’t acting in good faith, the steps you take early on can shape the outcome of your case. Here’s a practical approach to protect yourself and strengthen your position.

Step 1: Review Your Policy and Communications

Start by reviewing your policy. Look at the exact wording of your coverage, exclusions, and any conditions that apply. Compare that to your insurer's reason for denying or delaying your claim.

Read all letters and emails from the insurance company. Do their explanations make sense based on the policy language? Are they vague or inconsistent? These are key signs that something may be off.

If the terms are hard to understand or the situation seems complex, legal guidance can help. You can Selingo Guagliardo to review your rights under the policy.

Step 2: Keep Detailed Records

Document everything. Keep a written log of every phone call, including the name of the person you spoke with, the date, and a summary of what was said.

Save all emails, letters, voicemails, and other documents related to your claim. If you submitted anything, photos, estimates, or forms, keep copies. These records can help show how the insurer handled your claim and whether they acted unfairly.

Step 3: Escalate Within the Insurance Company

If you’re not getting clear answers, ask to speak with a supervisor. Explain your concerns calmly and directly. Request a written explanation for any delays or denials.

After any call, send a follow-up email summarizing the conversation. This creates a paper trail, making it harder for the insurer to shift its story later.

Step 4: File a Complaint with the State

You can file a formal complaint with the Pennsylvania Insurance Department if the issue isn't resolved. This step gets your concern on the record and forces the insurer to respond.

To file a complaint:

Gather your policy and all claim-related documents

Visit the Consumer Services section of the Pennsylvania Insurance Department website

Complete the online complaint form or call their toll-free line

Include a clear description of your issue and upload supporting documents

This won’t result in immediate payment, but it often prompts the insurer to act more responsibly.

Step 5: Contact an Attorney for Legal Help

If you’ve tried everything and the insurer refuses to treat your claim fairly, it may be time to get legal help. An attorney can take over communications, investigate the insurer’s actions, and determine whether you have a valid bad faith case.

A good lawyer will understand the pressure points insurance companies respond to. They’ll know how to demand accountability and protect your rights.

You can contact Selingo Guagliardo for help handling a bad faith insurance issue in Pennsylvania. The sooner you involve legal counsel, the better your chances of reaching a fair resolution.

What Happens if You Sue for Bad Faith

The Litigation Process

If your insurer refuses to resolve the issue after you’ve taken all the proper steps, filing a lawsuit may be the only path forward. A bad faith lawsuit begins with a formal complaint filed in court. Your attorney will outline how the insurer violated its duty and the harm it caused you.

Once the case is filed, both sides enter a phase called discovery. This is where each side gathers evidence. Your lawyer can request internal insurance documents, emails, and claim notes that may show a pattern of misconduct or unjustified denial.

Many cases settle during or after discovery, especially if strong evidence emerges. However, if the insurer refuses to take responsibility, the case may go to trial, where a judge or jury will decide the outcome.

Outcomes You Might Expect

If you win your case, you may receive more than the original claim amount. Courts in Pennsylvania can award:

The full amount owed under the policy

Interest on that amount, starting from when the claim was filed

Attorney’s fees and court costs

Punitive damages if the insurer’s conduct was especially egregious

In many cases, insurers settle before trial to avoid the risk of a larger judgment. A well-prepared case and legal representation often push them to resolve the matter fairly.

How Selingo Guagliardo Can Help

Insurance companies have resources and legal teams working to protect their bottom line. At Selingo Guagliardo, we help level the playing field for Pennsylvania policyholders who are treated unfairly.

Our attorneys have extensive experience handling insurance bad faith claims. We’ve represented clients in disputes involving wrongful denials, delayed payments, and lowball settlement offers. We know how insurers operate and how to hold them accountable.

Each case starts with a close review of the policy and claim history. From there, we build a strategy based on facts, documentation, and Pennsylvania law. Whether through negotiation or litigation, our goal is always to help you recover what you’re owed, and more if bad faith is involved.

You don’t have to face the insurance company alone. If you believe your claim is being handled improperly, we’re here to help you take the next step.

Bad Faith Insurance Frequently Asked Questions (FAQs)

-

Look for patterns. If your insurer denies a valid claim without an apparent reason, delays responses for weeks, or keeps asking for documents you've already submitted, those are warning signs. Another red flag is when the company offers far less than your documented losses and refuses to explain why.

-

Start by reviewing your policy and the denial letter. Request a detailed explanation in writing. Keep records of every communication. If the insurer’s explanation doesn’t make sense or they continue to delay, escalate the issue within the company, and consider filing a complaint with the Pennsylvania Insurance Department.

-

If a court finds your insurer acted in bad faith, you can recover the full value of your claim, plus interest, attorney’s fees, and court costs. In more serious cases, you may also receive punitive damages to punish the insurer for misconduct.

-

You have two years from the date of the bad faith action to file a lawsuit. That could be when your claim was denied, delayed, or lowballed without cause. Waiting too long can permanently bar your right to sue, so act quickly if you suspect bad faith.

-

You’re not required to have a lawyer, but it’s usually a smart move. These cases involve complex legal standards and strong pushback from insurers. An experienced attorney can build your case, gather evidence, and deal with your insurance company.